Sun May 05 2019 · 8 min read

Armenia’s Investment Potential is Substantial, But Internal Discourse Needs to Be Carefully Managed

By Samson Avetian

There is a lot of discussion in Armenia today about the degree to which a meaningful acceleration in the country’s economic and living standards can be expected and the outlook for business. Before providing an opinion on this, several matters need to be considered.

In Armenia, governments have come and gone. Some have been more respectable in terms of intellectual record and corruption record, others, one could claim, a bit less. First, it is important to understand that political change is one thing, economic change is another. A case in point is our immediate neighbor to the north. While Georgia went through a similar political and societal transformation some 15 years ago, with significant socio-political progress on many counts, its economic track record is far from what might have been expected at this point. The country’s net external liabilities (at 140% of GDP) are far higher than that of Armenia (at 80%). So is their trade deficit (-15% of GDP vs -12%). At the same time, GDP per capita, a measure of standards of living matches Armenia’s numbers (both at around 4,000 USD per person today and 1,200 USD in 2004).

There is no point in dwelling on the policy choices and macro fundamentals of our neighbor. The only emphasis that needs to be made is that political change does not automatically imply economic progress – at least in the short-to-medium term. Thus, we should not expect an immediate change in economic growth rates, nor take for granted an accelerated improvement in average employee productivity and, as a result, living standards.

Investment Decisions: Risks and Costs Today, Profits (hopefully) Tomorrow

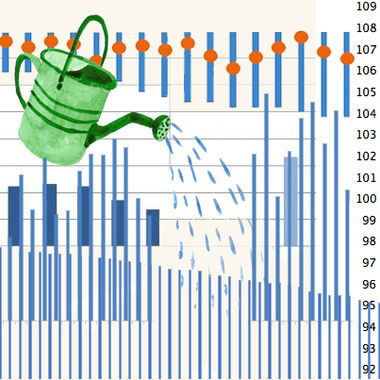

If economic development is a function of investment, and if the private sector is the main source of investment (at least in market oriented economies like Armenia), then it would be interesting to understand the dynamics, both rational as well as behavioral, behind a business owner’s investment decision. In other words, what are the drivers behind a positive investment decision versus a decision to postpone or, in the worst case, cancel a previously approved investment project?

Before exploring these dynamics, it is important to acknowledge that there are multiple trade-offs when making an investment call. On the positive side of the ledger, there is the expectation of higher revenues and profits down the line. On the flip side, beside the additional costs to be incurred today (as opposed to hopes and promises of payoff tomorrow), investing is inherently a risky proposition.

The risks are several; beside the incurred cash-flow issue noted above, the entrepreneur needs to be able to make correct predictions of future demand as well as supply growth (competitors). Of course, forecasting is difficult, and it is even a more complex exercise in a developing country settings with fluid political dynamics, where polls are unreliable, party ideologies regarding regulations differ widely, fiscal and monetary policies are blurred, etc. Secondly, investment is often financed by debt and can be cash draining for a company. This presents significant risk for a business (again, in the hope of a more prosperous tomorrow).

General Investment Criteria

Let’s now turn to the set criteria that need to be satisfied in order for a private investment project to get a green light. In a business owner’s calculus, three prerequisites need to be in place:

Unless it is a start-up, current business operations need to be profitable. Profitability also needs to be broadly in line with the company’s risk profile. It should surprise no one that in the absence of current profitability (or when profitability doesn’t compensate enough for the risks taken) a business owner would abstain from additional investment. Why would anyone extend the losses currently incurred?

Optimism regarding long term structural growth in the demand for the product or service offered by the firm. An investor needs to be confident that any additional output from expanded operations will need be realized at a profitable price not only in the short run, but also for years to come. One does not start a company, build a factory or invest in real estate, train employees only having 2-3 years of operations in mind. Any viable business model will be based on at least half a dozen years of projections.

Access to finance is the final prerequisite. Whether internally generated savings or, more likely, credit finance, a company needs to finance the often substantial investment with new funds.

As a side-note, in contemporary Armenian discourse we often hear that low interest rates and reduced corporate tax would have a substantial positive impact on investment activity. While not unimportant, and overall having a positive influence, cross-country data show only limited impact from these two variables. Their effect is overshadowed by the above mentioned three factors. Any cursory analysis of a corporate income statement would swiftly reveal the reasons for this.

Armenia 2019: Near term Considerations for Investment Outlook

In order to gauge the prospects of a meaningful investment acceleration in Armenia at present, it is helpful to refer to the three factors outlined above and explore how they have changed since Armenia’s political transformation in 2018.

With regard to profitability, the determination to reduce/eliminate corruption and move away from shadow economy settings, while noble, long overdue and essential, do in fact reduce a company’s profitability in the short run. This is because profit taxes now need to be paid, and so do social security and tax charges for previously unregistered employees. Furthermore, an investor naturally expects that the risk undertaken would be paid off with commensurate profitability. If profitability falls while risk levels are perceived to be unchanged, then the likelihood for making an investment seems unlikely.

When it comes to optimism regarding long term structural growth, the issue is quite complex.

In the short run, the transition of power, as well as changes in approach and value systems seem to be causing some friction and tension. This is understandable. Against the backdrop of ingrained methods, processes and incentive structures, the removal of barriers of entry for some business domains was bound to cause resistance and strains. Here it is also worth asking the question whether pursuing an “economic revolution” after the political one, was the best way forward or whether this was simply an unavoidable necessity given the level of resistance faced by the new Government. I will let the reader make a judgement call on this.

In any event, in Armenia and elsewhere, political dynamics do impact a business owner’s outlook on future revenue projections, earnings and investment. Investment activity slows in most places before an election or due to political uncertainties, because people need to be optimistic and comfortable when making investment evaluations.

Finally, with respect to the availability of finance, the issue is more straightforward. By and large, the banking sector in Armenia is in good shape with ample liquidity and opportune financial conditions both in Armenia and abroad. Nevertheless one needs to acknowledge that bankers need to be positively inclined themselves and not excessively risk averse when evaluating loan applications. Domestic dynamics do affect their perceptions of future economic outcomes as well.

To summarize the above, at least in the short run, investment outlook may be somewhat low. This is obviously regrettable. The optimal path would have been for the current lower levels of profitability to be at least balanced out by optimistic messaging on positive change and reforms in the future.

Long Run Outlook Necessitates Accelerated Investment

But if the previous discussion was mostly about how opportune circumstances are for an investment decision at present, then what about the scale or size of the investment to be made? If conditions were right, would the business owner decide to increase output capacity by 20% or 40%?

And it is here that the “Velvet Revolution” inspires plenty of optimism. No matter what future political constellations or dynamics might look like, certain business and economic practices are unlikely to return, raising long term growth prospects for Armenia.

One cannot overemphasize this point. Investment is a long term endeavor, and this is precisely in line with the structural improvements the RA Government is in effect putting in place. Structural growth (also known as trend growth or GDP potential) is based on productivity and demographics. With an independent legal system, fair competition and reduction in corruption, productivity is bound to improve noticeably – raising structural growth rates. And as an example, everything else being equal, a 10 year project will require +60% more investment today if structural growth projections improve from the previous 2% to 3% when reforms start to take root.

While the Government can take certain actions in the short run to aid growth, the near term outlook will likely be more impacted by fluctuations in oil prices and financial conditions abroad than domestic reforms at home. Reforms usually take years to filter through and raise productivity. But if structural growth is bound to improve, this will necessitate substantially higher supply/output/investment increases than previously projected.

Plenty of Potential – But the Messaging and Expectations Need to be Carefully Managed

It is easy to quibble about the government’s day-to-day decision making on economic matters. It is important to keep in mind though, that we are often unlikely to have enough insights and information about why any particular decision was taken. We also do not face the daily trade-offs the Government is facing and are unable to see these decisions in the full context of future plans and strategies. It is also reasonable to expect that some will try to distract and sensationalize for various reasons, domestic-political or geo-military.

There is no doubt that the question can be raised about whether some of the steps that were taken should have been less drastic. Usually in advanced countries, business related decisions are subject to in-depth analysis and stakeholder input. They are also introduced in phases over several years, if not decades (e.g. pollution control, zoning rights for commercial property like restaurants, electrical vehicle production/sales, moves towards renewable energy diversification). Let’s consider mining for instance. Mining should not and will not be the main driver of the Armenian economy. However, we also have to think of this issue as a trade-off between international contract law on the one hand (understanding that in the short term, and until a meaningful economic export reorientation, this sector brings much necessary foreign currency inflows), and how the environment weighs on economic activity on the other hand. This is not to argue that the protection of the environment is not noble and worthy of pursuit, because it is. It is more about the phased introduction of any changes deemed necessary, in order to increase certainty where business planning and investment are concerned.

To sum it up, any entrepreneur or business owner is primarily a human being with behavioral/emotional tendencies and a subjective interpretation of news and current events. Any reality can be portrayed and interpreted in at least two ways. If someone wishes to see issues in an optimistic manner, they will certainly be able to (i.e. confirmation bias), and of course vice versa.

There is plenty of potential for a meaningful and substantive increase in investment activity in Armenia. Entrepreneurs’ expectations just need to be carefully managed in order to see this acceleration happen already as early as 2019. Otherwise, the risk is that this structurally positive outlook may be drained and overwhelmed by the constant flow of uninspiring current events. Maybe, as seen in other places, news flow volatility will die down with time as the transition matures. But in all cases, there is just too much upside that may be left unrealized if communication and expectation management are not improved to the extent possible.

Samson Avetian is the author of “Armenia’s Economy the Next 25 Years: Three Ways to Restructure the Ugly, the Bad and the Beautiful”

also read

Taxes, Governance and the New Armenia

By Samson Avetian

There has been much discussion about the new tax reform being proposed by Armenia’s new government. Samson Avetian teases out some of the key issues of the reform.

Economic Revolution or Hopes for a Miracle

By Paruyr Abrahamyan

Can Armenia’s new government deliver on its promise of an economic revolution following the Velvet Revolution of last spring? Paruyr Abrahamyan decodes the promise of that revolution.

Reimagining Armenia: Economic Development and Creative Industries Proposal

By Lucyann Kerry

In the first of a series of articles, Dr. Lucyann Kerry proposes ways to reconfigure, reconnect and reconstruct the flow of resources, money/capital and human agency/interaction to revitalize the country based on successful models.

Revitalizing Armenia’s Transport System

By Lucyann Kerry

In the second of a multi-part series, Dr. Lucyann Kerry writes that as other countries set examples and move forward to solve transport problems, Armenia may have an opportunity to use its energized political will and seek innovative solutions to its transport system.