Over the past decade, the development of the Information Technology (IT) industry and the establishment of the information society have been a major impetus for increased competitiveness within the economies of all developed countries. Better productivity, management, innovation and scientific-educational systems, as well as the development of supporting infrastructure, have been recognized as priority areas—the cornerstone for building a knowledge-based economy.

The IT sector in Armenia is a strategic direction for the development of the country, taking into account existing realities, including the relatively high level of scientific and educational potential of the population, the traditional effectiveness of creative, scientific-research and applied work, as well as the limitations of territory, natural resources and transportation routes.

As early as December 28, 2000, the Government of the Republic of Armenia recognized the IT industry as one of the priority branches of Armenia’s economic development. In 2001, the “Information Technology Industry Development Concept” document was approved by the Government. On July 20, 2001, by Decree NH-896 of the President of the Republic of Armenia, the Information Technologies Development Support Council (ITDSC) was established, with the Prime Minister acting as chair. Being a liaison between the Government and IT businesses, educational institutions, NGOs, donors and international organizations, the ITDSC organized and conducted discussions promoting the development of the information society and resolving issues in the IT industry. On June 1, 2019, the goals of the Ministry of High-Tech Industry were formally defined by an executive order of the Prime Minister. The goals of the Ministry are to create and strengthen conditions for the balanced and sustainable development of high technologies, digitalization, cyber security, innovative technologies, communication, mail, Internet, the spheres of air and space, as well as create and strengthen conditions for ensuring the state’s economic growth. The new Ministry of High-Tech Industry replaced the Ministry of Transport, Communication and Information Technologies.

The Enterprise Incubator Foundation (EIF) was established by Government Decision N 1165 of November 27, 2010, within the framework of the loan agreement with the World Bank, in order to create preconditions for bringing Armenia's IT sector up to international standards. Viasphere Technopark has been operating since 2001, hosting more than 30 companies in the sector within its grounds.

Other legal acts related to the IT sphere include the Law On Electronic Documents and Electronic Digital Signatures (December 14, 2004) and the Law On Electronic Communications (July 8, 2005). As a result of cooperation with the Ministry of Trade and Economic Development, in 2005, the National Statistical Service of the Republic of Armenia developed and put into operation the monthly state statistical report form "On Information Technologies"—Form 1-IT.

A number of Cooperation Agreements and Memorandums of Understanding have been signed with other countries, such as India and Egypt, as well as world-renowned companies such as Microsoft, Alcatel, Hewlett Packard, Sun Microsystems, National Instruments, etc.

The main target indicators in the IT Industry Development Concept for the establishment of an information community are for 70% of households to have a computer, with that number being 80-90% for educational institutions, and 100% for state and local self-government bodies.

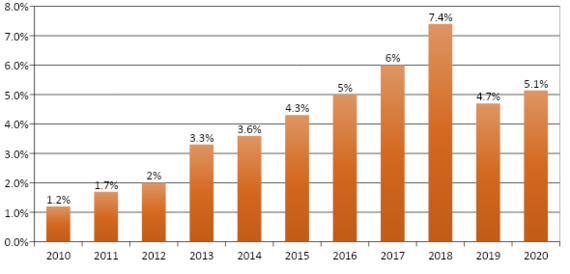

The share of the IT sector in the GDP of the Republic of Armenia in 2010-2020

The rapid growth of the global economy in the last decade is due to high-tech innovations and their application in various industries. Being a center of software development, industrial computing, electronics and semiconductor production during the Soviet era, Armenia continues to occupy a leading position in the region in the field of information technology in terms of its share in the country’s GDP, growth rate in the number of companies and total turnover.

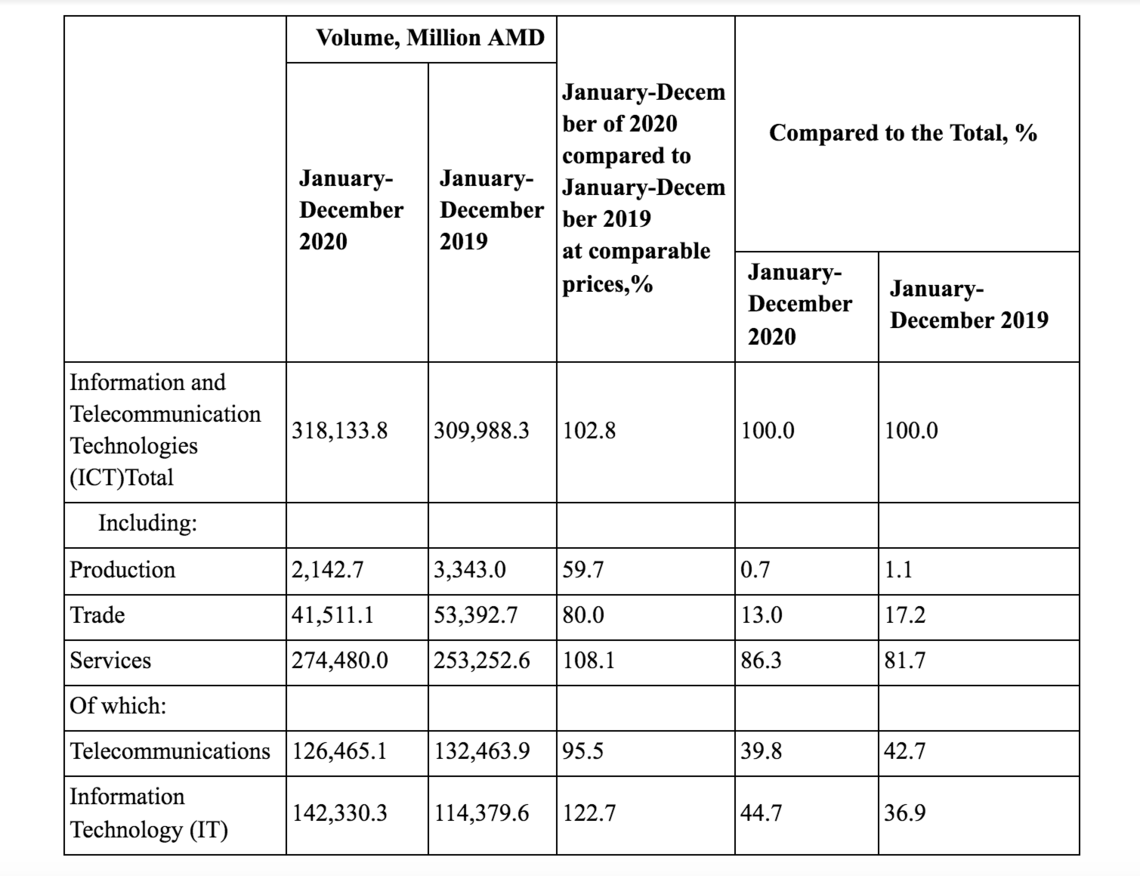

In 2019, the total turnover of the ICT sector amounted to about 309.9 billion AMD. A total of 800 active companies employed about 16,000 specialists. Despite a general economic downturn in 2020, the IT sector still grew by 2.8% compared to 2019.

Indicators of the information and telecommunication technologies (ICT) and information technology (IT) sectors by collective grouping based on type of economic activity

The presented table demonstrates that the IT sector registered 2.8% growth in 2020 in comparison to 2019. However, production in 2020 decreased by 40.3% compared to the previous year, trade decreased by 20%, while services increased by 8.1%.

It should also be noted that Armenia's software and services sector is quite young. Most companies, almost 95%, were founded in 2000-2018. The first private, local programming company was founded in 1987. The first branch of a foreign company was opened in Yerevan five years later. The technology sector experienced a rather difficult transition period in 1991-1997, when regional conflicts, a declining economy and the emigration of high-level professionals significantly hampered the overall recovery of the economy. In 1998, there were about 35 to 40 programming companies and Internet providers in Armenia, employing, according to various estimates, about 1000 specialists. The number of specialists working in the field in 1998 was significantly lower than in 1987, when the Yerevan Mathematical Machines Research Institute alone had up to 10,000 employees. Over the past eleven years, the sector has seen a sharp increase in the number of both local start-ups and branches of foreign companies. In 2017-2018, 150 new companies were established (18.8% of existing companies). During the same period, the number of jobs in the ICT sphere increased by about 4,200.

In 2020, the number of people employed in the IT sector was 14,755, of which only 95 were employed in the public sector, while 14,680 were employed in the private sector. For comparison, in January-March 2021, the number of IT employees increased by 4,202—more than 28%. It should also be noted that the IT sector is considered one of the highest paid sectors in the Armenian labor market. In 2020, the average salary for IT professionals was 411,927 AMD in the public sector and 638,756 AMD in the private sector.

Having a favorable environment for foreign direct investment in the ICT sector, Armenia has the following competitive advantages over other countries in the region:

-

Ability to carry out scientific research and experimental work in accordance with international standards

-

High quality and talented specialists

-

University foundation programs in IT and other related specialties, low-cost labor force with a high level of competitiveness and low operating costs

-

Tangible support provided by the state to the sector and the willingness to improve the investment field

-

Sustainable and continuous development of the IT sector

-

Presence of a strong and prosperous diaspora in Europe and North America

-

Extensive experience in cooperating with large transnational companies

-

A legal framework for the protection of intellectual property that meets the best international standards

The situation has significantly improved for local companies during the last five years: the number of employees has increased, venture investments have begun to flow, their technical skills and knowledge of the market have been improved and, moreover, they are implementing more complex and highly-valued projects. Armenian companies have become attractive for foreign venture investors.

Almost 73% of IT company representatives identify the lack of highly-qualified specialists as a problem, and 64.2% find attracting a highly-qualified labor force as problematic. The issue may be due to the continuous decrease in the number of students with technical specializations, along with the growth in demand for technical labor in the market.

According to 44% of IT companies, difficult access to financial resources and lack of support from state and non-governmental organizations hinders the growth of the software and services sphere.

About 23% of Armenian IT companies have certain problems entering the international market. At the heart of this problem is the fact that many international partners are unaware of Armenia or simply do not trust a representative from a low- or middle-income country.

The number of Armenian ICT companies developing their own products, and investing in scientific research and experimental work is growing year by year, which is a positive indicator that the ICT sector in Armenia is changing from an outsourcing platform for foreign companies to a center of technological development.

41% of operating companies generate revenue from their own products and services. In large companies, the amount of revenue from innovative activities is significantly correlated with the number of employees at the company; that is, the larger the company, the greater the amount of investment in scientific research and experimental work.

The number of local companies investing in scientific research has increased from 85% to 87%, which is due to the increase in start- up companies in the local tech sector.

Almost 63% of the 15,239 ICT technicians work in the software and services sector, while the rest of the technical workforce works in the telecommunications sector. The majority of ICT professionals in Armenia are male (68%). The average work experience of directors of IT companies is 13.4 years for local companies and 18.6 years for foreign companies. Local and foreign companies employ 52.5% and 47.5% of the IT workforce, respectively. This ratio was 50/50 in 2008.

Armenia is still considered a low-cost country for outsourced programming activities, with remuneration on par with major IT outsourcing countries such as India, Russia, Israel, Ireland, China and Central Europe.

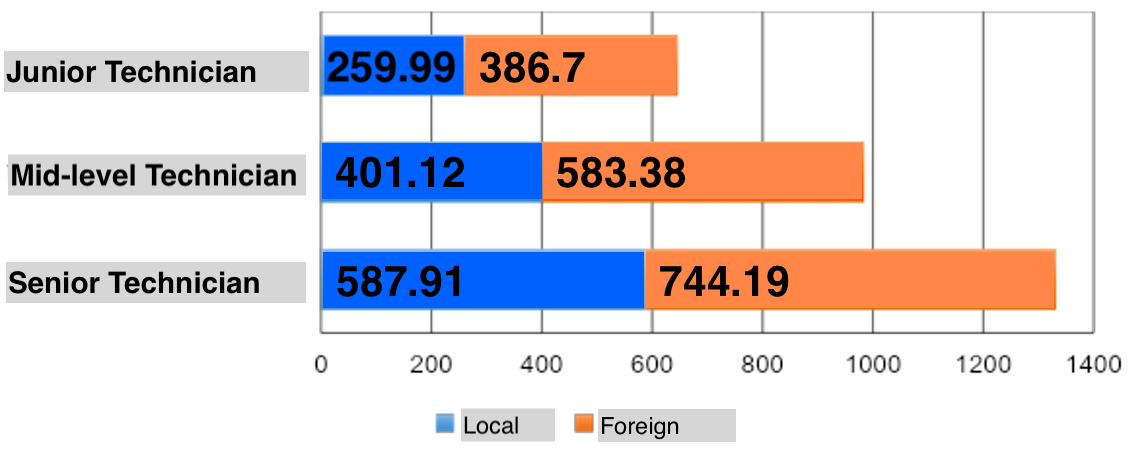

In 2020, the average nominal monthly salary of IT workers was 646,563 AMD (gross), which is the highest in the Armenian labor market. It is noteworthy that, even during the difficult economic conditions of 2020, the salaries of employees in this sector increased by 7.1% on average. Research shows that the salary of technicians is conditioned not by their educational level, but by work experience.

Average salary in Armenia’s ICT companies in USD

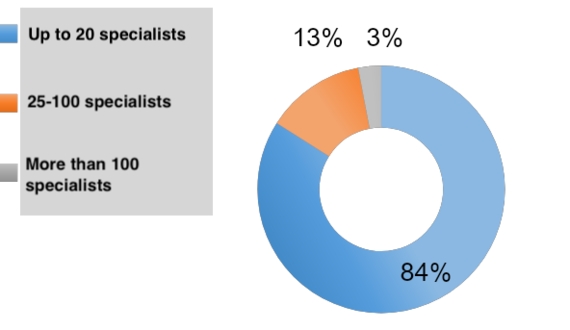

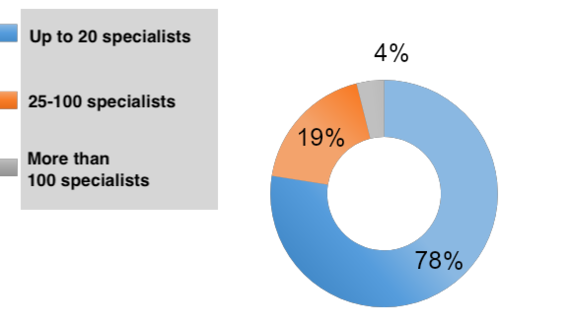

Only 3.4% of the companies employ more than 100 specialists, 12.6% employ 25-100 specialists and 84% employ less than 25 specialists.

Distribution of companies by size

Thus, it can be seen from the chart that small enterprises predominate. Indeed, the IT sector is one of the main sectors shaping the new middle class in Armenia.

also see

The Gituzh Initiative: Why Armenia Needs Science

By Rubina Davtyan

Prioritizing science will pave the way towards economic and strategic development. Formed by industry representatives, the Gituzh initiative is working to increase public awareness and government funding for science development.

High Tech, Low Culture: Armenian Creative Industries and New Media

By Vahram Akimyan

This is not a cyberpunk essay about a dystopian future, but rather an attempt to take a pragmatic look at creative industries and the landscape of digital culture in Armenia.

Digital Pomegranate and Distrikt: Connecting Tech to Sustainable Living in Gyumri

By Hovsep Markarian

Digital Pomegranate, already into its eighth year, has played an active role in shifting the image of Gyumri from a city of poverty and tragedy to a city with a viable future. Its new project, Distrikt, promises to be the first SDG compatible community in the world.

Edu2work: A Navigation Tool Bridging the Gap Between Education and Labor Markets

By Ruzanna Baldryan

How an AI-powered platform that analyzes thousands of online job postings from a wide variety of commercial websites to provide insights into the labor market can make data-driven decisions come to life.

Comments

Gabriel Armas-Cardona

7/13/2021, 5:45:17 PMCould you clarify your second-to-last graph, "Average salary in Armenia’s ICT companies in USD"? Are the bars supposed to be added together? So a senior technician in a foreign company makes 744.19 USD or 1332.1 USD?