The outbreak of the Covid-19 pandemic brought about a recession in tourism globally. At the time of writing this article, every global destination had some kind of travel restriction in place due to COVID-19 pandemic with probably longer lasting impact on international tourism and travel compared to other sectors that are expected to recover more quickly once major restrictions are lifted. Due to shaky economic outlooks and external shock of the pandemic, the short-term prospects for tourism are uncertain, while over the long-term, it is still expected to grow.

Economists argue that tourism revenue loss projections depend on whether and when lockdowns are eased or lifted, to what extent normal economic activity is resumed, and whether subsequent spikes in infection rates will entail more lockdowns. Long term projections are difficult to make because we simply do not know what the virus is going to do. Meanwhile, countries more dependent on tourism will be more severely affected.

The pandemic provides real-life examples of some of the dangers of overreliance on tourism without economic diversification. Most obviously, it reduces a country’s autonomy through overdependence on external factors, such as foreign travelers and climate change. More than that, however, an overemphasis on tourism in the long term can also create a kind of brain drain, as people take jobs with relaxed education and training requirements, i.e. in the service sector, exacerbating unemployment and resulting in a smaller variety of skills that would have otherwise helped the economy recover.

How COVID-19 Affects Tourism in the South Caucasus

The growing importance of tourism to the region, however, implies its higher vulnerability to the crash in tourism revenues this year as the pandemic takes its toll.

Currently, Armenia, Azerbaijan, and Georgia have banned foreign nationals from entering their countries. Azerbaijan and Georgia have suspended all flights to their countries with few exceptions. Armenia is still served by a limited number of Belavia and Redwings flights. Georgia and Armenia have agreed to close their land border until further notice. Similarly, both Armenia and Azerbaijan have closed their borders with Iran, allowing only some cargo deliveries.

In Armenia, the State Tourism Committee President Susanna Safaryan announced that in the first quarter of 2020, 150,000 less tourists visited Armenia year-on-year, leading to a loss of approximately $135 million. Safaryan predicted a worsening of the situation for the second quarter given the suspension of flights and the closing of borders.

In Georgia, 90 percent of bookings were cancelled for the month of April. There is a possibility that Georgia will face recession if tourism numbers do not recover by fall. While Georgia plans reopening to incoming tourism from July 1, 2020, it remains to be seen to what extent travelers erring on the side of caution will forgo nonessential travel, and how that will affect tourism numbers.

Azerbaijan has been less forthright in terms of spread and economic toll of the pandemic, while Armenia and Georgia have been quite transparent. The number of cases in Azerbaijan is most likely suppressed and not reflected in the official figures. Specific data for the pandemic’s impact on Azerbaijan’s tourism sector is not available, but given the small contribution of tourism to Azerbaijan’s GDP vis-à-vis Georgia and Armenia, the pandemic, most probably, will not be as severe there. Crucially, however, in April the pandemic led to a fall in the price of oil, which comprises more than 90 percent of Azerbaijan’s exports. As Azerbaijan has maintained its currency’s peg to the dollar, it has to spend billions of dollars to defend its currency, making the pandemic much more taxing for the country.

Hotels, guest houses and other accommodation businesses, as well as tourism related service providers will be worst hit. In Armenia, the government has discussed ways to help the tourism industry, including government-subsidized loan programs, as well as lending to small and medium-sized enterprises in tourism. Safaryan also says that while this will help mitigate losses, this will not fully cover the amount of support needed. Similarly, the government of Azerbaijan is providing preferential-term loans to its businesses to mitigate the economic impact of the pandemic. Georgia has also approved a $312 million package which includes a tax holiday and loan repayment assistance to support its tourism industry.

Global Tourism before COVID-19

Global tourism saw steady growth over the last six decades, despite war, terrorist attacks, natural disasters, and energy crisis around the world. International tourist arrivals reached 1.5 billion in 2019 and the number of arrivals was forecast to rise to an estimated 1.8 billion by 2030. Moreover, international tourist arrivals in emerging economies were projected to grow at twice the speed of those in advanced economies. In 2019 alone, spending on travel and tourism accounted for 10.4 percent of the GDP globally.

In general, tourism is seen as a good thing, beneficial for any country, with more relevance for developing economies, where it supports economic development, creates jobs, and helps build country image and identity, bringing much needed money to local economies and contributing to the improvement of infrastructure and access to modern conveniences. It directly benefits the communities that provide goods and services, enables the communities that lack material wealth but are rich in culture, history and heritage, and supports the establishment of complex and diverse supply chains of goods and services, such as tour guides, translators, cooks, cleaners, hotel managers, which support a more versatile labor market.

Tourism in the South Caucasus before COVID-19

Nestled between the Black and Caspian Seas and the greater Caucasus mountain range, the three Caucasian States – Armenia, Azerbaijan, and Georgia - recently became increasingly popular with tourists, while previously they were not well-known as travel destinations beyond Russia and the former Soviet region. Incoming tourism in the region gradually increased since the 1990s, with pick-up in 2010 as air travel increased and tourists discovered the region as a destination of surprisingly diverse landscapes and unique mixes of western and eastern cultural elements. Georgia is the destination for the largest number of tourists, followed by Azerbaijan and Armenia respectively. In all three states, the overwhelming majority of tourists come from Russia, while the number of visitors from Europe is on the rise. Tourism, by all accounts, has been thriving and growing in all three countries, being a major contributor to GDP with a whopping 26 percent for Georgia, around 11 percent for Armenia and 7 percent for Azerbaijan in 2019.

Country-specific Data

Armenia

Just some data: According to the CEIC, an economic data provider, the number of incoming visitors to Armenia was 1.7 million in 2018 - an increase from 1.5 million in 2017. More Stats: 2016: 1.26 million; 2015: 1.2 million; 2014: 1.2 million; 2013: 1.08 million; 2012: 963,000.

Armenia’s tourism industry was arguably kick started by Diaspora Armenians from North America, Europe, and the Middle East, who started visiting Armenia in the 1990s. More recently, Iranians have been an increasingly visible tourist group; Armenia has no visa restrictions, offers greater freedoms, is affordable for the Iranians. Visiting Armenia during Nowruz has become a popular practice with around 20,000-25,000 Iranians visiting per year. Moreover, from 2016-2017 there was a 64% increase in visitor arrivals from China and a 236% - from the Philippines.

Armenia’s historical and cultural sites and in particular its medieval monasteries and churches are great attractions for visitors. The country has three UNESCO World Heritage sites – two medieval monasteries, and a cathedral and archaeological site. Wine tours and tasting, as well as gastro tourism is gradually blooming in Armenia as it sets up more wine and food festivals like the Yerevan Wine Nights, Areni Wine Fest and various traditional food festivals in the provinces of Armenia. Sustainably run wineries are also becoming popular in Armenia, offering the visitors wine tours and tastings, and creating local jobs. A recent shift of focus to sustainable development in Armenia has led to slow, yet gradual development of ecotourism infrastructure, including skiing, rafting and biking. While this sector and concept is yet new to Armenia, creation of new hiking trails is well advancing.

However, Armenia is the least visited country in the region, but its tourism sector is expected to grow in the context of recent opening of low-cost flights to European cities operated by budget airlines. Armenia has a fairly liberal visa regime to facilitate tourism – nationals of most European countries and the Commonwealth of Independent States, as well as Argentina access visa-free entry. Many visitors of other nationalities can get a 21-day or a 120-day visa at the border, while some, including those of African and Middle East countries, require invitations.

Azerbaijan

Just some data: According to CEIC, an economic data provider, the number of incoming visitors to Azerbaijan was 2.6 million in 2018 - an increase from 2.45 million in 2017. More stats: 2016: 2.59 million; 2015: 2.74 million; 2014: 3.16 million; 2013: 3.03 million; 2012: 2.62 million.

According to Azerbaijan’s State Committee on Statistics, more than 2.4 million tourists visited Azerbaijan between January and September 2019. The majority of these visitors were from (in descending order) Russia, Georgia, Turkey, and Iran. British tourists prevail in the cluster of European nationals visiting Azerbaijan, with an increase of 25.3 percent between 2018 and 2019. Nationals of South Asian countries have also been visiting Azerbaijan in increasing numbers, with India in the lead with an increase of 66.8 percent between 2018 and 2019.

International events held in Azerbaijan have played a crucial role in strengthening the country’s tourism profile. In 2012, Azerbaijan hosted the Eurovision Song Contest, bringing thousands of first time visitors to its capital. The government stated it spent $100 million preparing for the event, accelerating construction projects and importing London taxis to Baku. In 2016 and 2017 Azerbaijan hosted the Formula One race and the European Games, respectively, treating both as attention-grabbing, image-boosting events.

Overall, most tourists visiting Azerbaijan are attracted to Baku’s historic areas and monuments. Baku’s Old City showcases historic Azerbaijani architecture with more than 50 historic monuments, including the Palace of the Shirvanshahs, named a UNESCO World Heritage site in 2000. Tourists are also drawn to Azerbaijan for its geological attractions, including the mud volcanoes of Qobustan, also a UNESCO World Heritage Site, as well as sites where natural gas burns continuously from the ground.

Several years ago, after Azerbaijan’s exposure to market vulnerabilities due to its overreliance on oil, the country decided to analyze sustainability models existing in different countries with similar profiles: relatively small size, diverse natural habitats, distinct cultural heritage and a young population. Hence, Iceland became an inspiration for Azerbaijan to use tourism as a way to diversify its economy. In May 2018 the government created the State Tourism Agency and Board as the official body for tourism promotion, which now has more influence and resources than the previous program run by the Ministry of Culture.

Of the three South Caucasus countries, Azerbaijan has the most expensive and restrictive visa regime, despite government pursuits of visa simplification by introducing an electronic visa system for visitors in 2017. The list of citizens eligible for an e-visa was extended in 2019 to include a total of 95 countries. Visa fees differ by nationality - from no fees for the nationals of Japan to $160 for those of the U.S. Visas are available on arrival at Baku’s Heydar Aliev Airport only for Turkish and Israeli citizens, as well as those with officially approved invitations. Lonely Planet, the travel guide publisher, notes that ‘procedures change frequently, and rules may vary between different embassies, but don’t assume things will be easy.’

Georgia

Just some data: According to CEIC, an economic data provider, the number of incoming visitors to Georgia was 4.76 million in 2018. This is an increase from 4.07 million in 2017. More stats: 2016: 3.3 million; 2015: 3.01 million; 2014: 2.94 million; 2013: 2.88 million; 2012: 2.46 million.

Georgia received over 5 million tourist visits in 2019, an increase of 6.8 percent since 2018. Of the groups with the most significant rise in visits for this period were Israelis, whose visits rose 198.4 percent and Chinese, whose number grew by 52 percent.

Georgia’s tourism sector is the most developed of all South Caucasus countries. It is growing to become a significant aspect of the country’s economy, with approximately $3.2 billion revenues generated in 2018. Georgia’s government has ambitious goals of attracting more tourists from Europe, North America and the Middle East, to elevate tourism revenues to $6.6 billion by 2025.

An increase in the number of low-cost flights from different parts of Europe has boosted its tourism industry. Georgia’s democratic Rose Revolution also arguably played a role in increasing tourist inflows, as the shift brought upon widespread reforms, including a crackdown on corruption and massive government spending on development creating a more attractive environment for the tourists. Georgia is also a favorite outbound destination for Armenian and Azerbaijani tourists.

Tbilisi and Batumi’s Black Sea coast are most popular destinations for visitors of Georgia. Tbilisi’s historic district with its unique urban heritage, which to some extent still preserves its history of multinational and multi-confessional modes of life, is a UNESCO World Heritage Site. At the 2019 World Travel Awards Ceremony, the Europe’s Leading Tourism Destination award went to Batumi, with its pebbly beaches, serving as the destination for 29.7 percent of incoming trips to Georgia. Georgia’s mountains – which claim to be four of Europe’s highest peaks – are also popular destinations for climbing and skiing. Hiking in Georgia’s rural, off-the-beaten path areas is also becoming more popular, with the Georgian National Tourism Administration spending $600,000 to renovate around 20 trails in 2015. Wine tours and wine tasting, in particular in Georgia’s eastern Kakheti region, known for its hearty, simple cuisine and affordable hotels, are also becoming a part of Georgia’s international image.

Georgia’s visa regime, the most liberal of the South Caucasus countries, allows many nationalities, including Americans, EU nationals, South Koreans, and Russians a visa-free entry for up to a year. Those in need of a visa can apply online.

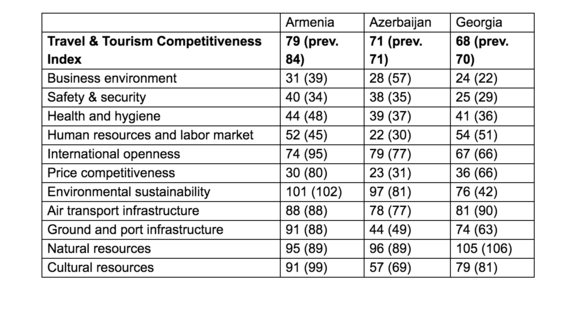

The Table below provides the Travel & Tourism Competitiveness Index 2019 for the three countries (Rankings out of 140)

also watch

Understanding the Region: Energy in the South Caucasus

Once-integrated energy channels were disrupted with the fragmentation of the Soviet Union and the unfreezing of frozen ethnic conflicts in the South Caucasus. In the mid-1990s, Armenia, Azerbaijan and Georgia began rebuilding their impaired energy infrastructures. How have these countries with different degrees of European and Russian influence and different energy needs and natural oil and gas reserves fared so far and what do they have in common?

The State of Democracy in the South Caucasus

The three states of the South Caucasus – Armenia, Azerbaijan, and Georgia gained their independence from the Soviet Union in 1991. As these countries embraced new freedoms and democracy, how have they fared?

Understanding the Region: The Eurasian Economic Union (EAEU)

The Eurasian Economic Union (EAEU) was established in 2015 with the objective of creating a shared economic space with a single customs union. This short video explains its purpose, goals, weaknesses and more.

Understanding the Region: The Collective Security Treaty Organization (CSTO)

EVN Report is proud to launch the first in a 10-part series of Special Reports in three languages (English, Armenian and Russian) about national and regional issues, associations, alliances and more. Each month, we will release a short video accompanied with a fact sheet to help bring greater clarity to the political, economic and social issues facing local, national and regional populations in the South Caucasus. This first Special Report is about the Collective Security Treaty Organization.